Net, Gross, & Operating Profit Margins: What Is High?

Updated August 7, 2023

Two popular metrics commonly used to gauge the success of a business are profit margin and net profit. And, while net profit is great at reflecting how much profit is generated from revenue, for some applications, it's arguable that a business's profit margin is a more valuable metric. This is because profit margin allows you to gauge how efficiently your business is running overall.

Understanding these metrics—involving income, revenue, and profit—and the benchmarks of each of these can provide insight into a business's overall profitability.

» Book a demo with BeProfit and learn how to calculate profit and other metrics with just one tool

Difference Between Net, Gross, & Operating Profit Margins

These three metrics are commonly used to analyze and measure the income of a business. All three metrics differ based on industry and business size and are typically not stagnant. To help you better understand the differences between the three margins, consider learning more about:

1. How to Calculate Net Profit Margin

Net profit margin is a measure of profitability. It's calculated by determining a business's net profit as a percentage of revenue.

Net Profit Margin = [(Revenue - Cost) / Revenue] x 100

For example, in e-commerce, the average net profit margin is 0.64%, whereas the average total market net profit margin is 7.77%, as reported by NYU Stern School of Business. But this can fluctuate depending on a number of factors, such as the number of sales, merchandising costs, and product prices.

Another way to look at net profit margin is by using a net profit margin ratio. The net profit margin ratio is just another way to measure a company's profitability.

Net Profit Margin Ratio = Net Income / Revenue

This ratio tells you how much profit a company makes on each dollar of sales. Simply put, a high net profit margin ratio means that the company is making a lot of money on its sales. In contrast, a low net profit margin ratio means that the company is not making as much money on its sales.

2. How to Calculate Gross Profit Margin

The gross profit margin differs from the gross profit and is expressed as a percentage. Gross profit margin is the percentage of revenue that remains after paying the cost of goods sold (COGS). The average, per NYU Stern School of Business, sits around 33% for all industries, and 42.78% for e-commerce, particularly.

Gross Profit Margin = [(Revenue - COGS) / Revenue] x 100

This calculation is useful because it measures the efficiency of the business's operations, provides a benchmark for measuring other business expenses, and shows changes in gross profit margins over time. Thus, e-commerce businesses prove to be excelling at managing operational costs efficiently for a maximal gross profit margin.

If you find your gross profit margin is low, however, you can look into reducing COGS, including lowering shipping costs or cutting out unnecessary expenses like excess staff or unneeded operational costs.

» Need help managing expenses? Keep track of your e-commerce business expenses

3. How to Calculate Operating Profit Margin

Operating profit margin (or return on sales) is the ratio of operating income to net sales. This is usually expressed as a percentage.

Operating Profit Margin = (Operating Profit / Revenue) x 100

The operating profit margin ratio is used to determine how well a company can cover operating costs with revenues. In other words, how effective a company is at generating profits from its sales. This is a useful performance indicator when making comparisons to similar companies. The average total market operating profit margin is 13.52%, with the e-commerce industry at 5.85%. This can change drastically based on net sales or even streamlining operational processes to lower costs.

» Find out how to calculate gross profit percentage

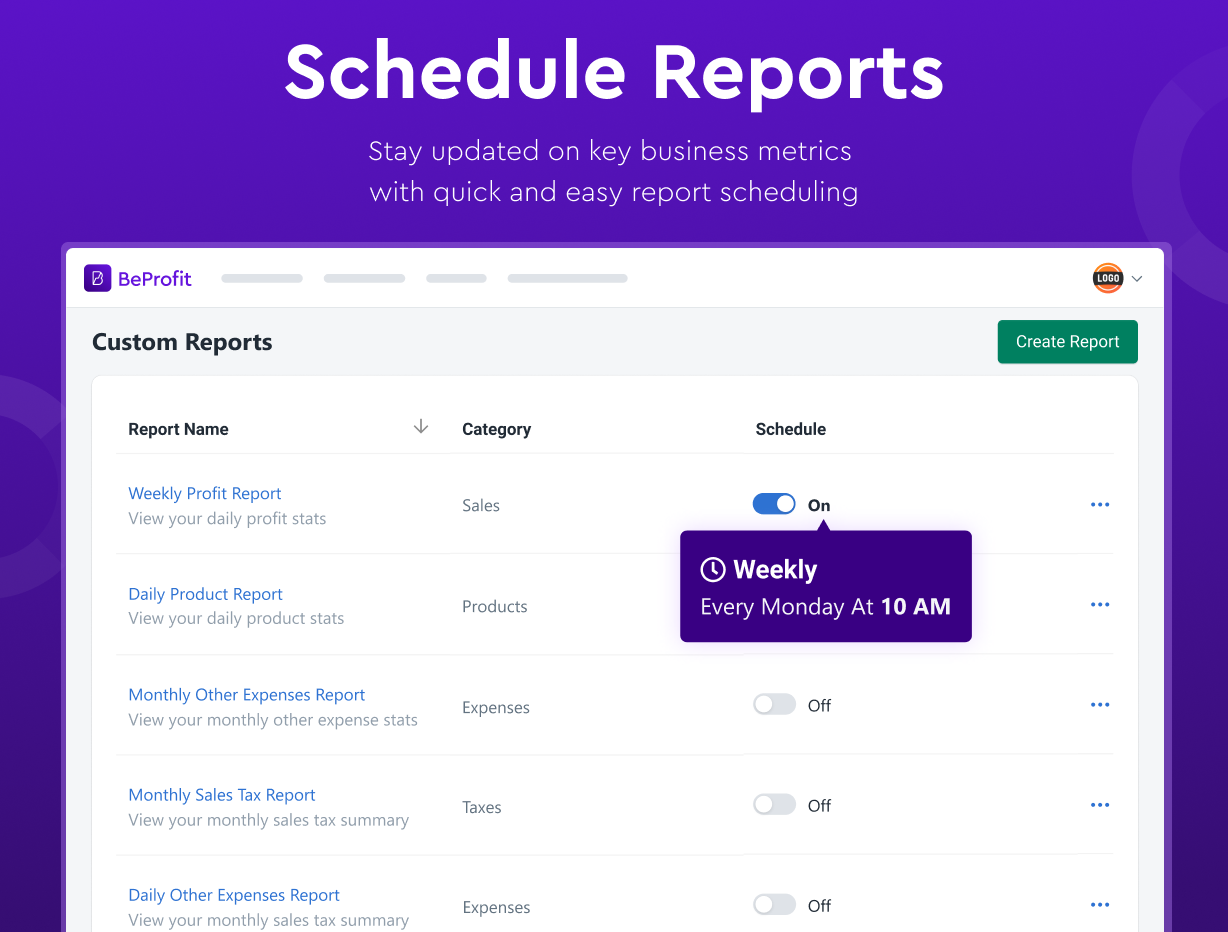

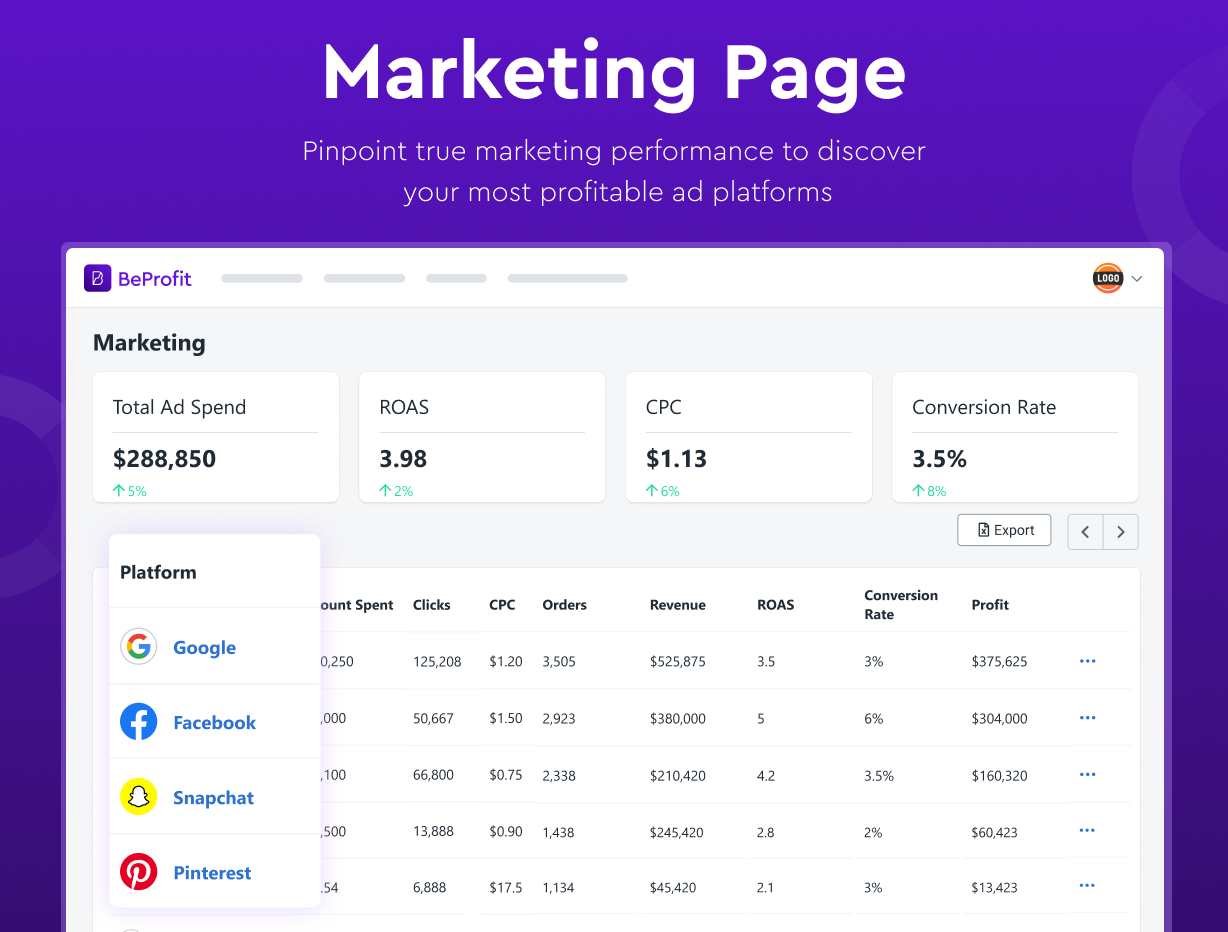

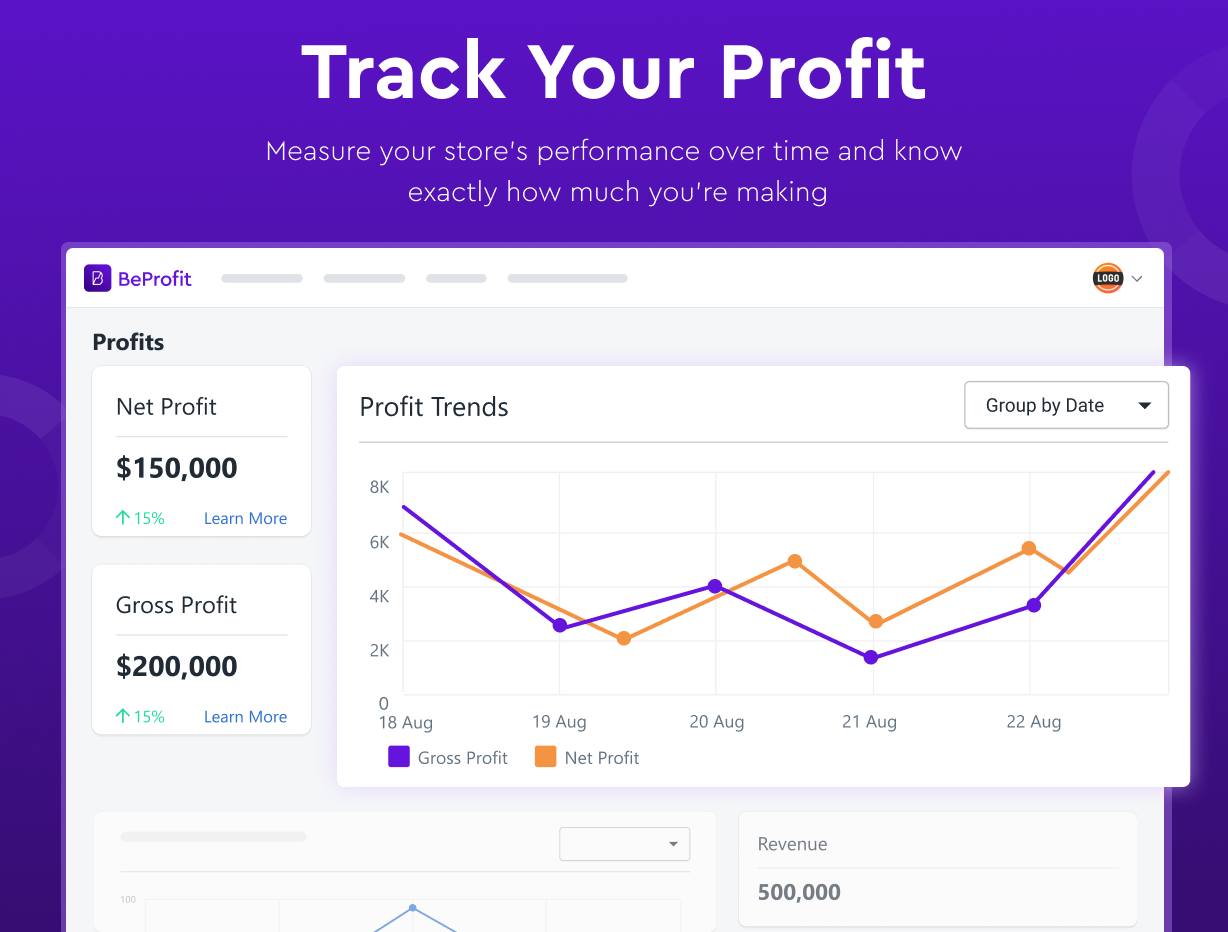

Easily Track and Analyze Your Profits

View and manage your profit trends on one dashboard.

- Provides a complete business and financial overview.

- Access to real-time data and custom reports.

- Link multiple platforms and shops for an aggregated view.

BeProfit's app makes it simple to track and analyze your profit margins, saving you time and effort.

Benefits of Knowing Your Profit Margins

The ultimate goal for a business is profitability. If your sales are up, but your margins are down, you may need to take a deeper look at how you're running your business.

A business with a good profit margin is able to remain afloat during tough times and capitalize on opportunities, such as seasonal marketing strategies, to help boost sales. A high-profit margin means that the company is making enough money on each sale to cover its costs and generate a positive return on investment (ROI) for continued growth.

A high-profit margin also sends a positive signal to potential investors, lending credibility and stability to the business.

» Learn about effective cost leadership strategies to help improve profitability

Limitations of Profit Margin Calculations

To calculate a profit margin, business owners need to calculate total revenue and total expenses. This can be complex. Research and development (R&D) costs are expensed in the year in which they occur, while depreciation expenses are spread out over the life of the asset.

Profit margins also don't always consider changes in sales volume. If a company doubles its sales volume but keeps costs constant, the profit margin doesn't change. If a company reduces its sales but also lowers expenses and increases prices, its profit margin will increase. Calculating profit margins is not an exact science, and the outputs, while helpful, should be considered an estimation.

» Discover how to perform a profitability analysis for your e-commerce store

Knowing These Margins Can Help Improve Profitability

Because margins can fluctuate and depend on a number of factors, knowing the benchmark values can provide an estimated guideline to assess your business. Ultimately, a good profit margin is essential for maximizing company growth, understanding how other successful businesses in your industry are performing, and achieving optimizing your processes. If you have low-profit margins, tracking these same metrics on all-in-one platforms, like BeProfit's, can offer useful insight for making sales strategy adjustments, operational optimizations, and improving revenue management.