E-commerce Shipping Insurance In 2023: What Are Your Options?

Published June 8, 2023

Running an online store in 2023 requires shipping insurance. There are various risks during the shipping process you need to think about: parcels can be lost, damaged, or stolen before your customers even lay a finger on them. According to the 2022 Package Theft Annual Report from Security.org, nearly one out of every six Americans (49 million people) experienced package theft in the last year.

Shipping insurance provides coverage for your e-commerce business against these incidents, protecting you from potential losses. While it may seem like an additional expense, shipping insurance is worth its price. Let's explore the different types of shipping insurance available for e-commerce sellers in 2023.

Different Types of Shipping Insurance

- Flat-rate shipping insurance

- International shipping insurance

- Third-party shipping insurance

- Carrier liability insurance

- Return shipping insurance

- All-risk insurance

1. Flat-Rate Shipping Insurance

Flat-rate shipping is when customers pay a fixed price for shipping, no matter the size and weight of the package. The insurance rates for flat-rate shipping depend on the value of the shipped goods.

Best For

If you frequently ship parcels of different sizes and weights at a fixed shipping rate or deal with a high volume of goods, you can consider flat-rate shipping insurance. For example, a subscription box company that ships boxes of different sizes and weights to customers every month.

Pros

- Covers basic risks of shipping parcels

- Cost-effective solution for high volumes of goods

Cons

- May not cover international shipments

- High-value items may not be included in the coverage plan

2. International Shipping Insurance

Since international orders cross oceans and borders, they have a high chance of being misplaced or damaged.

Best For

International shipping insurance is a good option if you engage in a lot of overseas business. For example, an online retailer that sells handmade jewelry worldwide may find international shipping insurance essential to protect their valuable products during international transit.

Pros

- Customizable coverage according to destination, value of goods, etc.

- Comprehensive insurance for international orders

- Works well for high-value shipments

Cons

- More expensive than other types of insurance

- May not be valid in the country you're shipping goods to

3. Third-Party Shipping Insurance

Third-party insurance is the most common type among e-commerce sellers because it provides an extra layer of protection for packages at a lower cost compared to major carriers.

Best For

If you ship a wide range of products in various sizes and weights, then third-party shipping insurance can give you more protection for different goods. For example, a small boutique selling clothing, accessories, and home goods could opt for third-party shipping insurance.

Pros

- Offers broader coverage than carrier insurance

- More cost-effective because of lower prices

- Straightforward claims process

Cons

- Possibility of fraud from unscrupulous third parties

- Limited availability depending on types of goods being sold or area of operations

» Follow these expert tips to reduce your shipping costs even more

4. Carrier Liability Insurance

Every major carrier offers the option to purchase insurance while shipping packages. This transfers responsibility for the package’s delivery and safety from the seller to the carrier, providing an extra layer of protection.

Best For

Consider carrier liability insurance if you ship high volumes of standard-sized packages. For example, an online bookstore specializing in paperbacks could rely on carrier liability insurance for their regular shipments.

Pros

- Covers basic risks of shipping parcels

- Offered by most shipping services

Cons

- Limited coverage in cases of damage and loss

- May not extend to providing coverage for high-value items

5. Return Shipping Insurance

Speedily accepting returns and dispatching replacements is crucial in online retail. Return shipping insurance protects the buyer and seller from shipping costs if unsatisfactory products are returned.

Best For

Return shipping insurance can be particularly useful if you offer free returns. For example, an online electronics retailer with a generous return policy.

Pros

- Proven to improve customer satisfaction levels

- Affords the seller peace of mind in case of unhappy customers

Cons

- Can be costly depending on the number of returns

- Limited coverage based on each return claim’s eligibility

» Need to slash your shipping times to speed up returns? Here's how

6. All-Risk Insurance

This is the most comprehensive form of coverage available for e-commerce retailers. It protects goods against all risks that might be present at any stage of the supply chain, providing end-to-end coverage and peace of mind.

Best For

If you sell and ship expensive or designer items, all-risk insurance can give you peace of mind because your valuable products may be targets for theft. For example, a luxury goods retailer that sells high-end jewelry or watches can use all-risk insurance to protect their shipments.

Pros

- Covers both domestic and international shipments

- High coverage limits protect even high-value items

Cons

- More expensive than other types of insurance

- A rigorous claims process might delay payouts

» Worried insurance will make your shipping costs too expensive? Here's how to easily calculate your shipping costs

Why Consider Shipping Insurance for Your E-commerce Business?

Whether your e-commerce business is large or small, customer expectations for shipping are extremely high, making it a highly competitive market. According to a 2021 survey by UPS Capital, 81% of small and medium businesses experience lose time, money, and reputation when shipments go astray. You should consider shipping insurance as a safeguard for your business, especially if you ship goods frequently or deal in high-value items. The key benefits of having shipping insurance for your e-commerce business are:

- Customer satisfaction: 65% of consumers surveyed by UPS Capital would prefer purchasing insurance for online shopping orders.

- Protection from losses and damages: Your business will no longer be liable losses due to theft, damage, or misplacement of orders.

- Competitive advantage: Smaller online stores can compete more effectively with larger corporations by offering efficient shipping options with shipping insurance.

Factors and Requirements That Can Impact E-commerce Insurance Rates

- Shipping destination

- Package type and size

- Declared value of goods

- Shipping carrier

- Transportation type

- Type of coverage (stock damage, physical damage, customs rejection risks, and exhibition risks)

- Insurance type

- Documents required (airway bill, packing list, and invoice)

Sail Your E-commerce Business to Success With Shipping Insurance

Shipping insurance is an essential part of long-term success for every e-commerce business in 2023. With 96% of consumers expecting free shipping and 76% expecting free returns, it's more important than ever to insure your packages. To achieve success, find the type of shipping insurance that best suits your business.

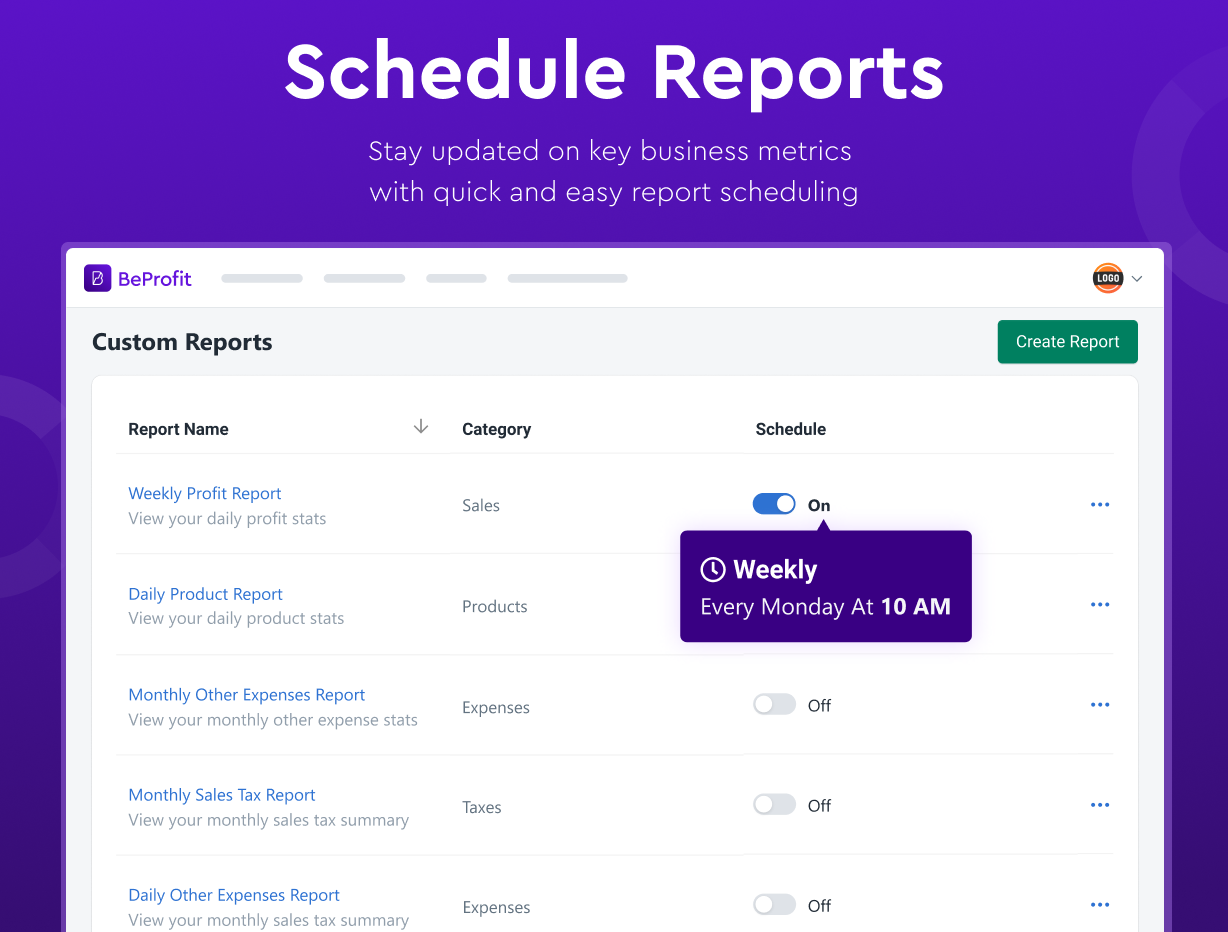

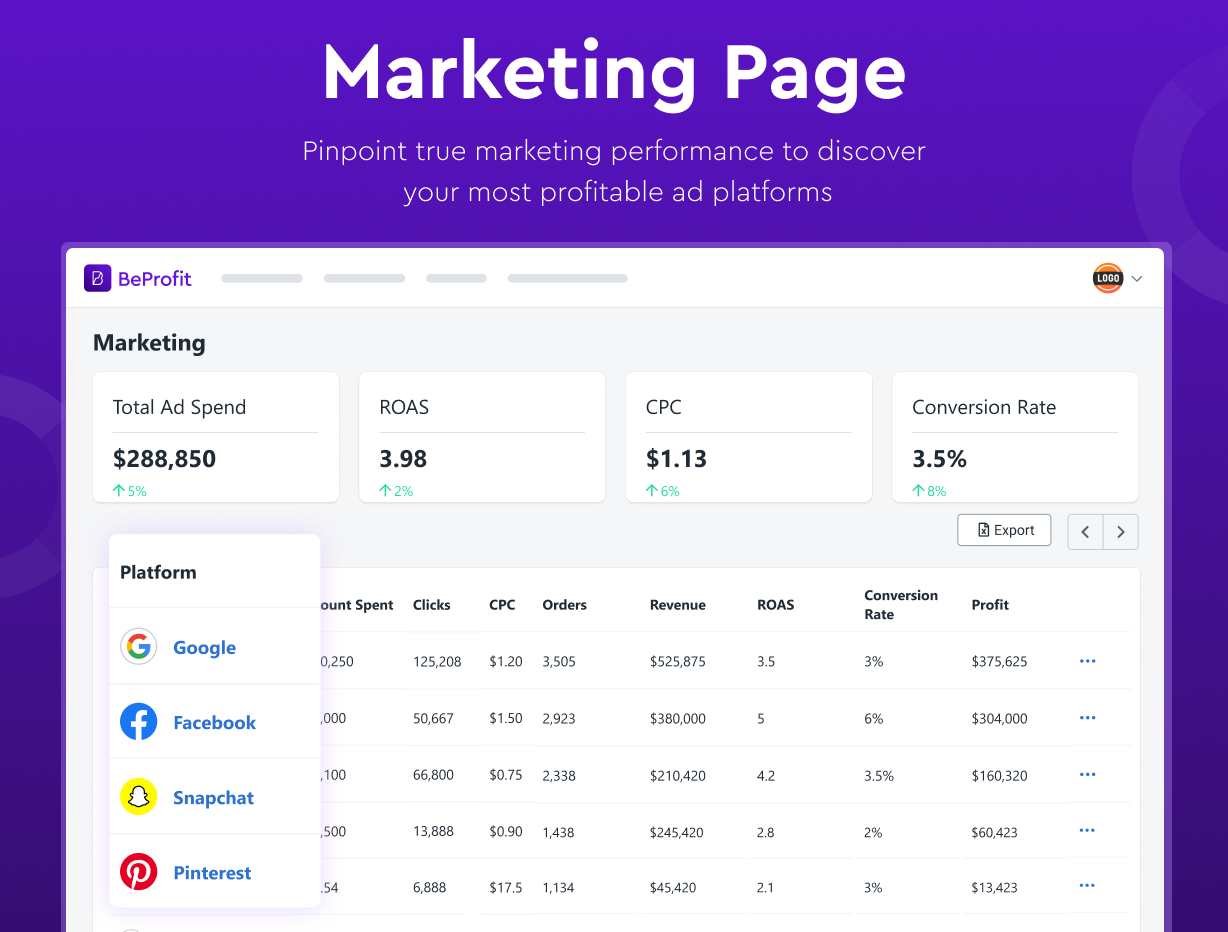

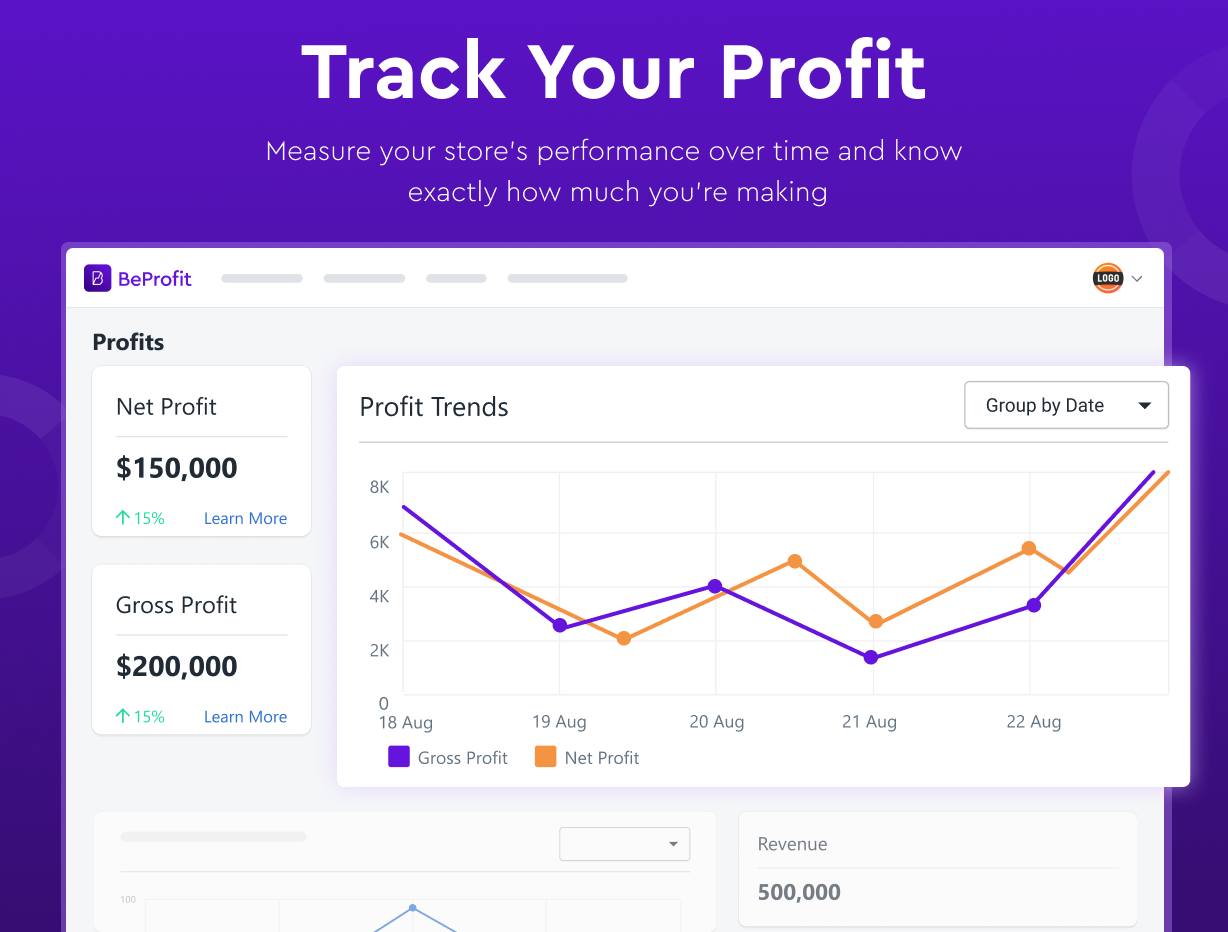

Another way to enhance your store's performance is by closely monitoring it with the right tools. BeProfit is an all-in-one e-commerce dashboard that integrates sales, advertising, and shipping platforms, providing up-to-date, customizable business performance data reports. With the peace of mind from shipping insurance, you can focus better on data analysis and get the most out of your e-commerce enterprise!

» Stay up to date with the latest shipping benchmarks and insights