How to Calculate Cost of Goods Sold (COGS) for your Shopify Store

Updated April 21, 2023

Like any business owner, Shopify store owners need to keep track of their revenue. One of the essential metrics used to determine a business's revenue is the cost of goods sold (COGS).

To help you determine your Shopify store's COGS, we'll break down everything you need to know about this business metric, including how to track COGS with Shopify and how to include COGS in Shopify. That way, your next tax season will be a little bit more bearable.

How Do We Define COGS?

Simply put, COGS is the amount of money a business spends to produce a product. There are two key components of your COGS:

- The cost of materials to manufacture the product

- The cost of the labor necessary for a business to sell each unit while ignoring indirect overheads (like marketing).

COGS is deducted from a business's revenue in order to calculate sales metrics like gross margin and gross profit, meaning: The higher the cost of goods sold, the lower the revenue margins.

However, some business costs will not be included in your COGS. Knowing what to include and exclude can help you calculate more accurate values.

| Included Costs | Excluded Costs |

|---|---|

| Cost of labor | Distribution costs |

| Materials | Marketing |

| Manufacturing overheads | Administrative expenses |

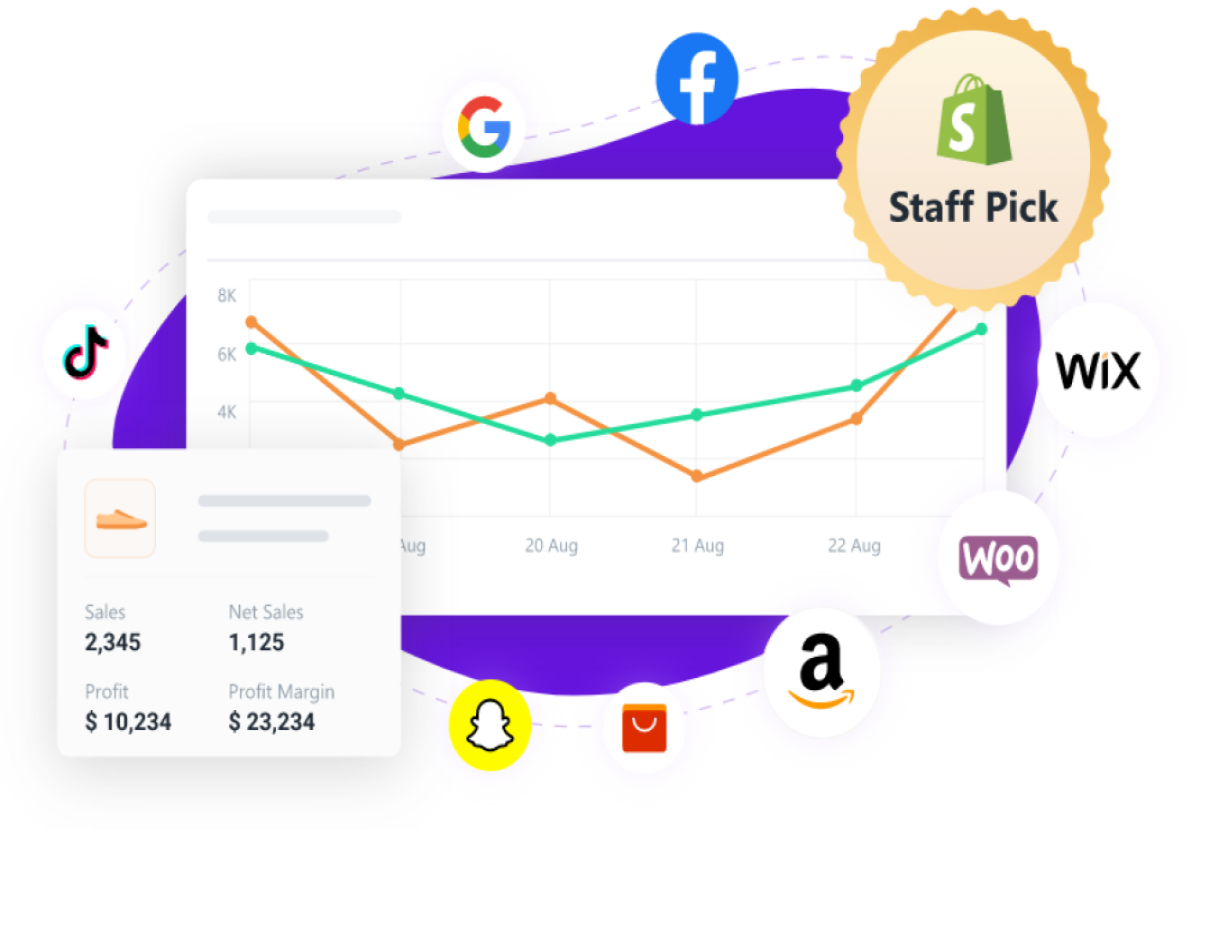

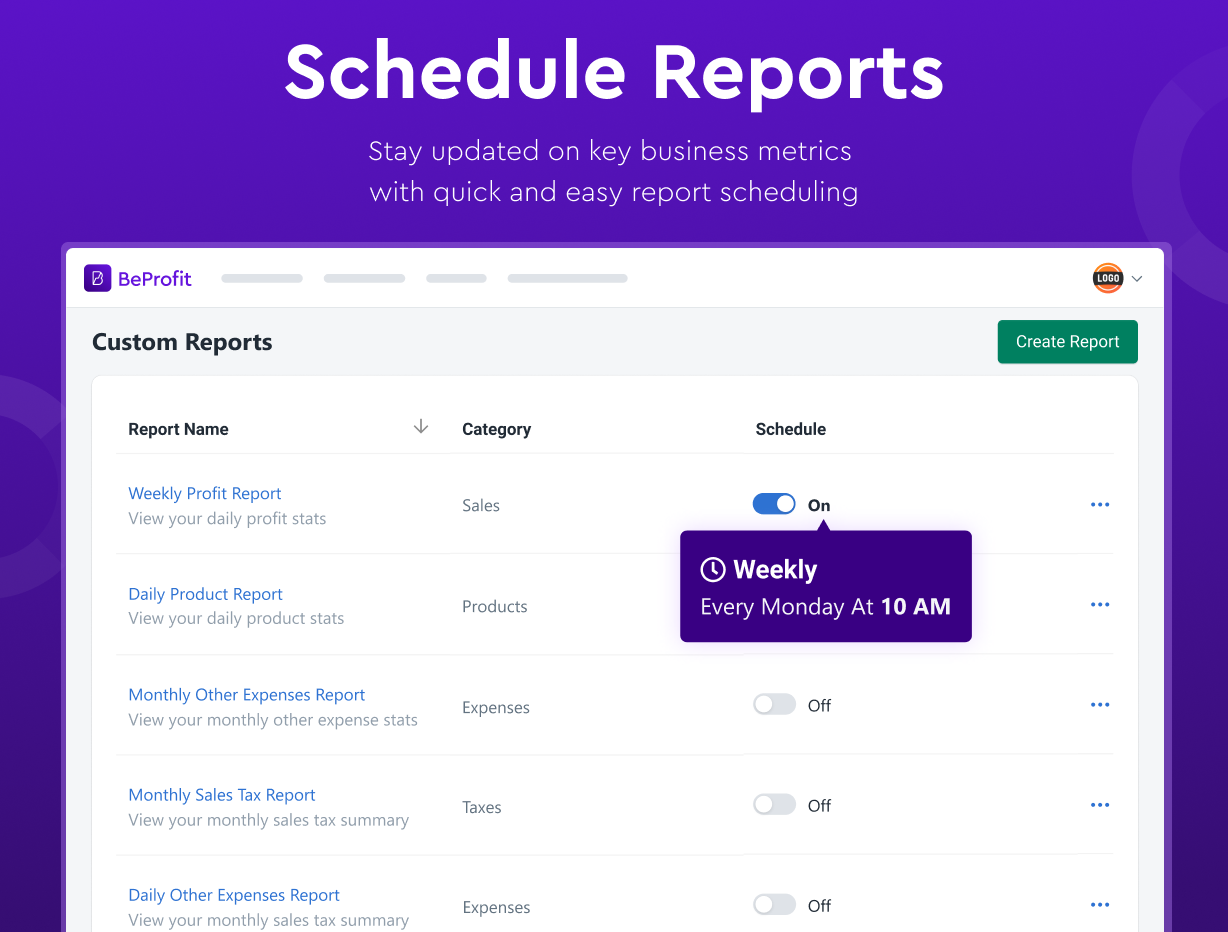

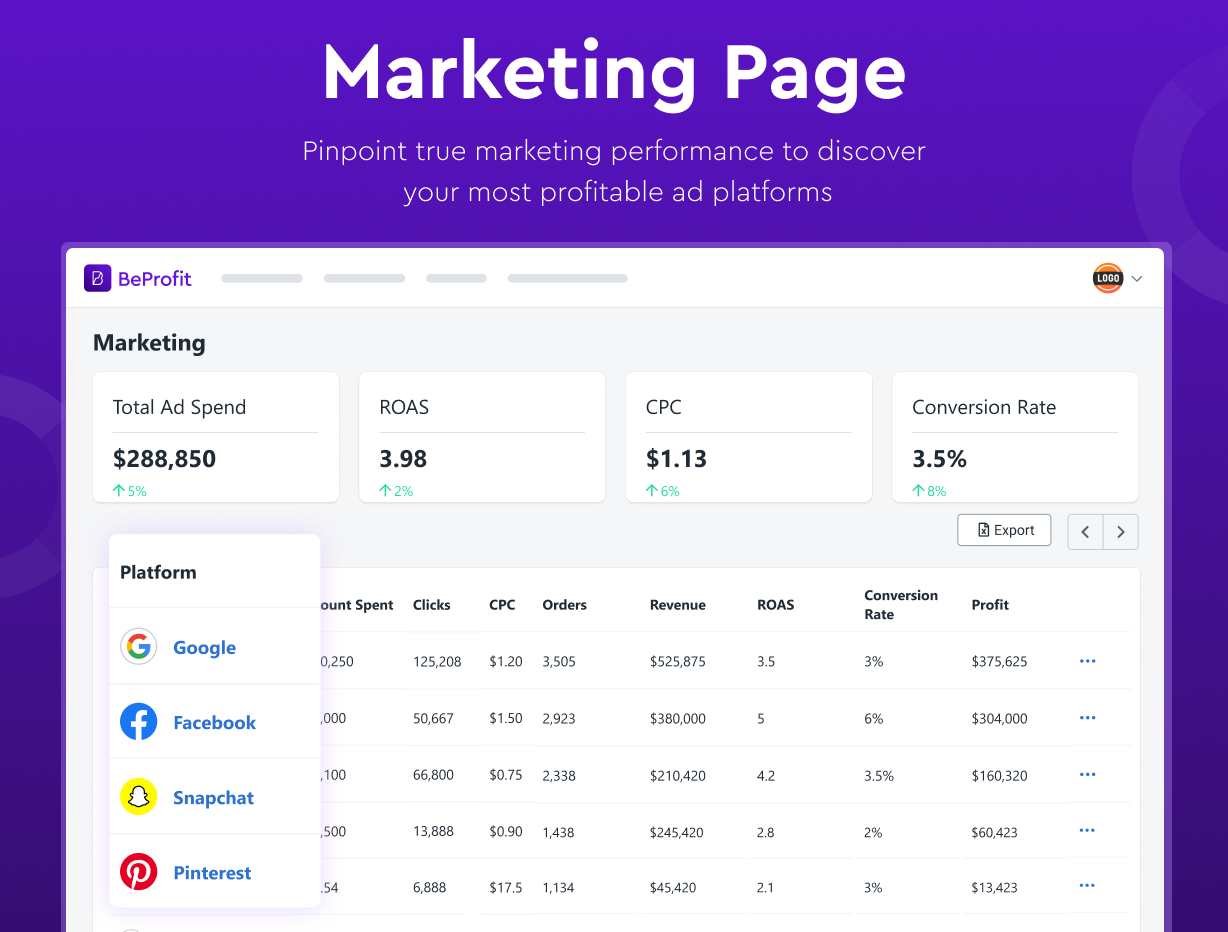

Track Your Expenses With Ease

Spend less time on expense and profit tracking by using seamless integration.

- Provides up-to-date reports on your business expenses.

- Can integrate multiple Shopify stores into one dashboard.

- Accessible on mobile and desktop devices for easy team collaboration in real time.

BeProfit provides an easy-to-use platform to help you monitor your key metrics and calculate COGS without hassle.

Shopify COGS: How to Calculate It

This should be done for a specific period—whether that be for the year, quarter, or month. For Shopify store owners on the Shopify plan or higher, finding the variables that go into calculating COGS is fairly straightforward. By accessing your "Finances summary report" in your Shopify Admin, you can gather an overview of your store's finances for a certain period.

But understanding COGS and how to calculate it can better inform your business strategies and better comprehend your business's performance. Using the following COGS formula and the correct variables, you can deduce your cost of goods sold:

COGS = (Starting Inventory + Purchases) - Ending Inventory

For clarity, here's a COGS example calculation:

- Let's say your beginning inventory is $10,000 at the start of the year.

- During a 12-month period, you spend an additional $5,000 on materials, products, and labor.

- At the end of the year, you calculate your ending inventory to be $8,000.

- That means your COGS is equal to $7,000.

Finding the average cost of goods sold is the same for small businesses as for large businesses, whereas the actual values may change significantly.

» Is your COGS high? Learn how to reduce your COGS

Direct and Indirect Business Costs

As a quick summary, direct costs are the immediate costs that go into manufacturing a good or service. In contrast, indirect costs are those general business expenses that are necessary for keeping your business operating. Knowing which type of cost each of your expenses falls under can help you calculate your COGS accurately. Here's a quick breakdown of each:

| Direct Costs | Indirect Costs |

|---|---|

| Raw materials used in production | Maintenance, utilities, and repairs |

| Conversion costs | Depreciation on production machinery |

| Direct labor costs | Other factory overhead costs |

Importance of Knowing COGS

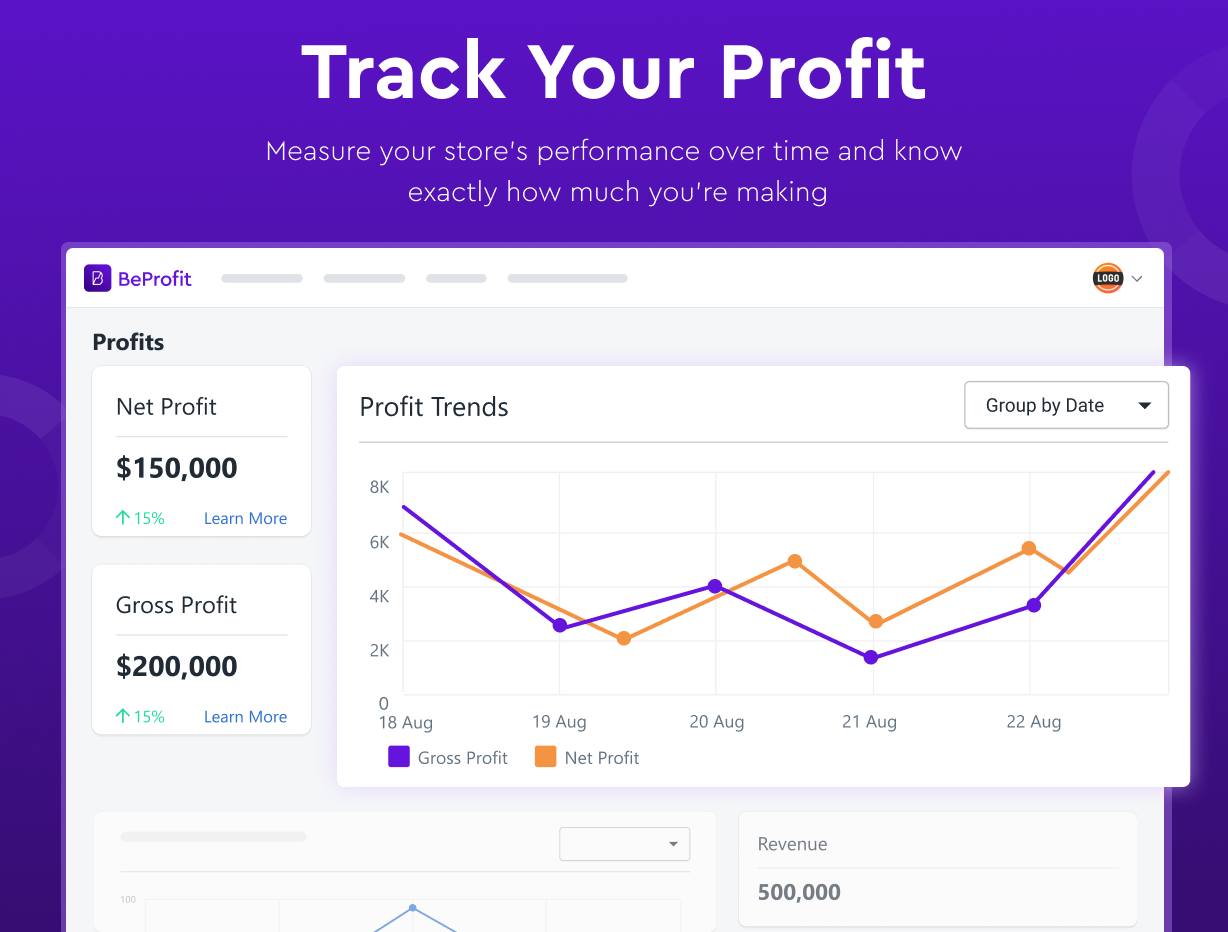

COGS can determine whether a company has a positive or negative gross profit. Subtracting the COGS from your revenue can help determine your gross margins and gross profits. If the COGS is too high, the gross profit will be significantly impacted, making your business less economically viable in the long run.

Knowing your COGS can help you assess what areas of your business you need to adjust in order to maximize profit.

Importance of Keeping an Accurate Inventory

Aside from the obvious reasons for keeping an accurate inventory, such as allowing potential customers to see how many products you have in stock, an accurate inventory is also vital in allowing you to calculate COGS correctly. The inventory left from the previous period acts as your starting inventory when calculating your COGS. Without an accurate estimate of inventory, your COGS will be skewed, which will ultimately impact how your business's profit is calculated.

How to Make COGS Tracking as Easy as Possible

Keeping on top of everything while running an e-commerce store certainly isn't easy. Thankfully, with the help of Shopify apps, you are able to perform many tasks easily, such as pricing your products and shipping your orders. With BeProfit's Profit Analysis Dashboard, specifically, you can monitor your inventory, integrate your data into one hassle-free dashboard, and track your expenses to simply calculate your COGS, revenue, and profit.

» Learn how to use the COGS formula to analyze your Amazon business's profitability