Manage Journal Entries in Your Periodic Inventory System Like a Pro

Updated April 12, 2023

As an experienced data professional in the e-commerce supply chain and inventory management field, I understand the importance of inventory management for businesses operating on tight margins. Effective inventory management and utilizing journal entries can help businesses avoid stockouts, optimize stock levels, and reduce carrying costs. And with the periodic inventory system, the process is fairly minimal.

What Is the Periodic Inventory System?

The periodic inventory system involves taking a physical count of your inventory at regular, specified intervals—such as weekly, monthly, or quarterly—to determine the ending inventory balance.

This method is typically used by smaller businesses with low inventory turnover rates, as it is more cost-effective and requires less manpower than the perpetual inventory system which tracks inventory levels regularly. Documenting your inventory usage can:

- Help deduce the cost of goods sold (COGS) per accounting period

- Identify which items drive profits

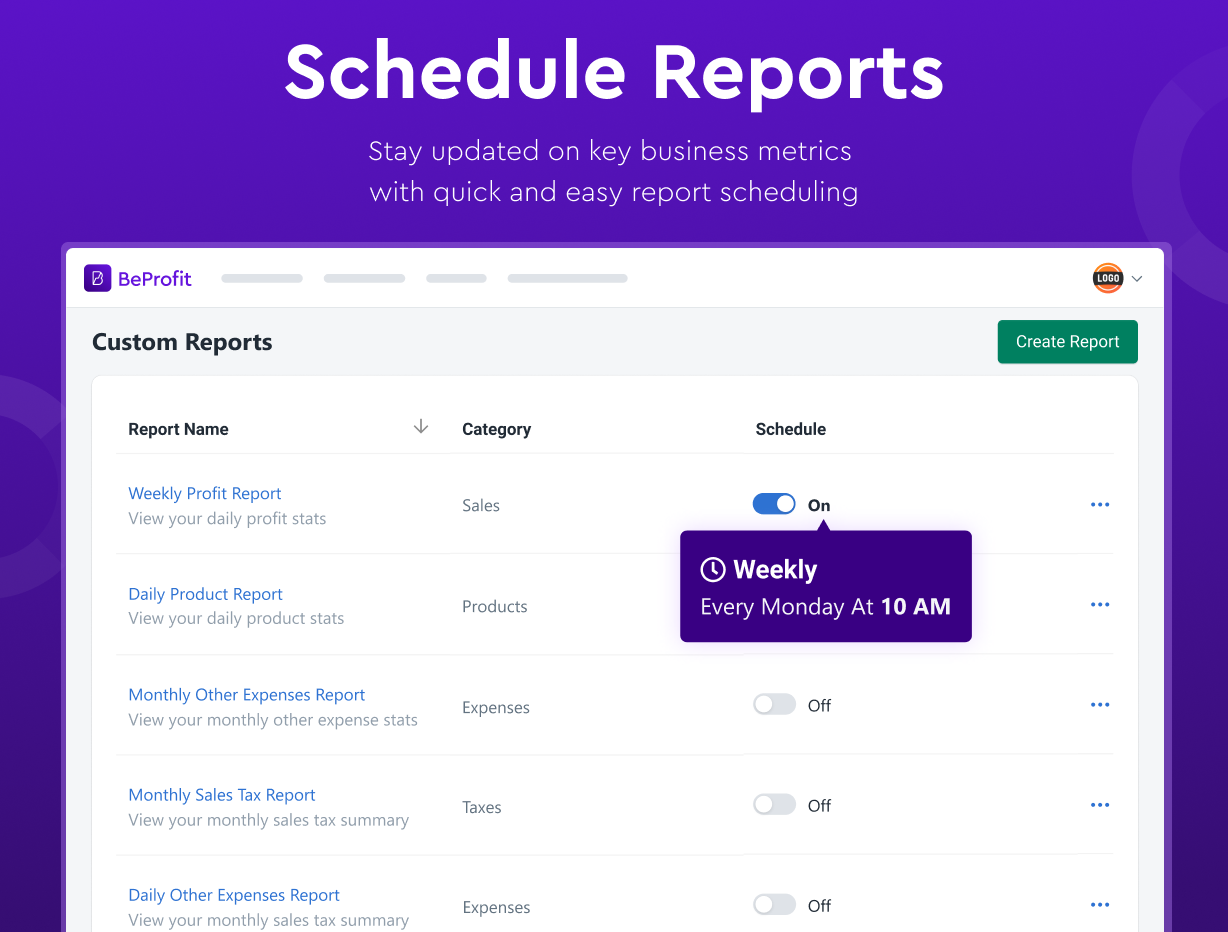

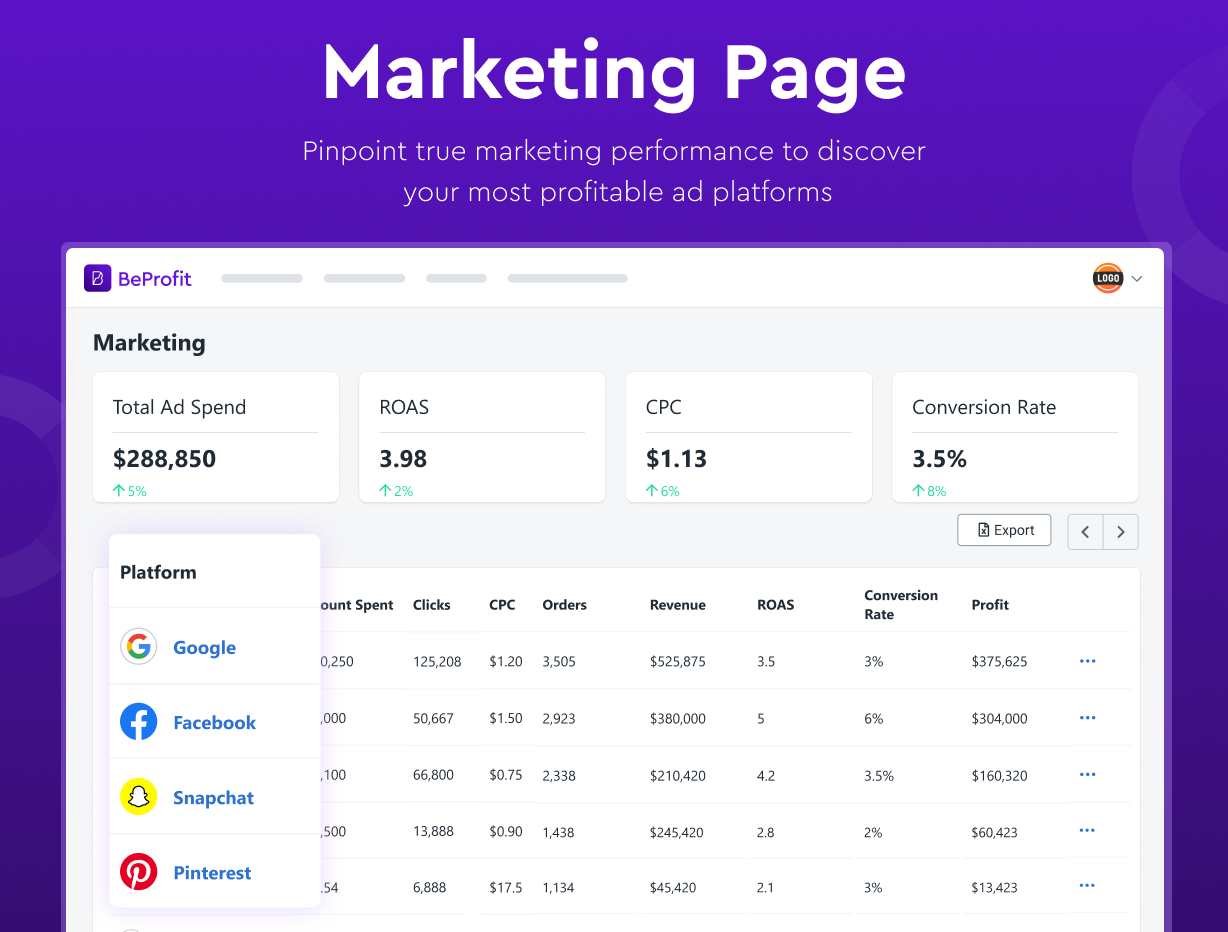

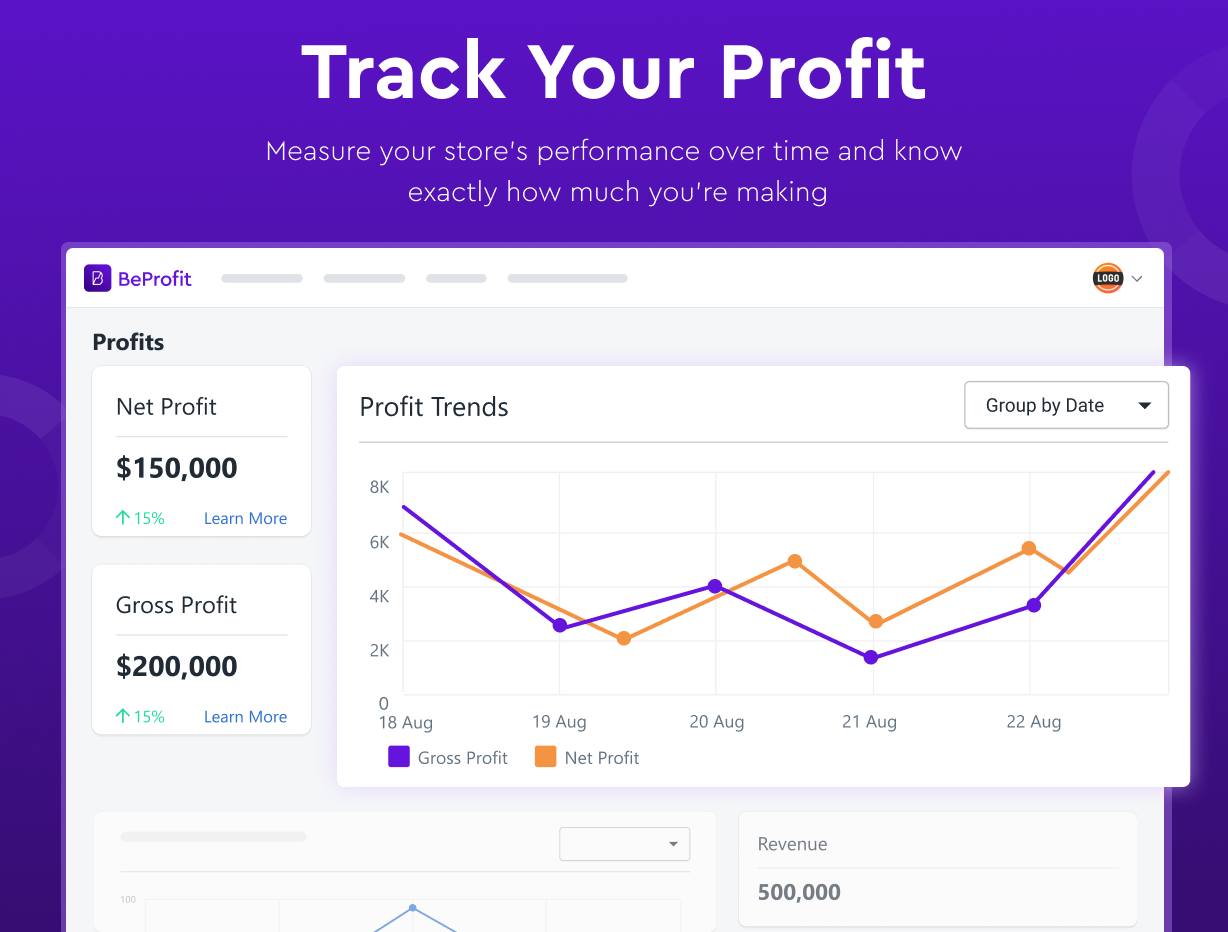

Make Profit-Tracking Hassle-Free

With journal entries to help you keep your inventory in check, tracking your expenses and profits can be simple, too, with an all-in-one integrative system.

- Uses UTM attribution to identify your best-selling and most profitable products.

- Accessible on desktop and mobile devices.

- Customize your data reports and edit your store's data to your liking.

BeProfit offers a seamless platform to help you manage your expense and profit data for easy analysis of your business's performance.

How to Use Journal Entries

Journal entries are used to record transactions by date in the periodic inventory system. Tracking how much inventory is costing the business over a period can help track expenses that can be reduced, ultimately helping improve revenue.

To illustrate how journal entries are used, let's look at an example of a small camping gear retailer that uses the periodic inventory system.

The retailer purchases 200 camping bags for $50 each and starts the accounting period with 100 bags in stock. During the accounting period, it sells 150 bags for a total of $12,000. The period ends with 250 bags in stock.

The goal is to perform the necessary periodic journal entries to update inventory accounts and help ensure accurate financial statements.

Record the Purchases

The first step is to record the purchases of the camping bags in our inventory account. The business bought 200 bags for $50 each, for a total cost of $10,000. To record this transaction, use the following journal entry:

| Account | Debit | Credit |

|---|---|---|

| Inventory | $10,000 | |

| Accounts Payable | | $10,000 |

Record the Sales

Second, record the sales of the camping bags and the COGS. The business sold 150 bags and the cost per bag is $50, so the COGS is $7,500.

| Account | Debit | Credit |

|---|---|---|

| Cost of Goods Sold | $7,500 | |

| Inventory | | $7,500 |

The debit to the COGS account represents the expense we incurred in selling the bags, while the credit to the inventory account reflects the decrease in our inventory assets due to the sales.

» Find out how to calculate cost of goods sold (COGS) for your Shopify store

Adjust the Inventory

Next is a physical count of the inventory at the end of the period to adjust the account and reflect the actual inventory on hand. The business counted 250 bags with a total cost of $12,500.

| Account | Debit | Credit |

|---|---|---|

| Inventory | $5,000 | |

| Cost of Goods Sold | | $5,000 |

The debit to the inventory account represents the increase in our inventory assets due to the adjustment, while the credit to the COGS account reflects the expense we incurred.

Calculate the Final Inventory Balance

| Account | Debit | Credit |

|---|---|---|

| Beginning Inventory | $5,000 | |

| Purchased Inventory | $10,000 | |

| Cost of Goods Sold | | $7,500 |

| Ending Inventory | | $7,500 |

The below table shows the final inventory balance for the camping gear at the end of the accounting period.

| Account | Beginning Balance | Purchases | COGS | Ending Balance |

|---|---|---|---|---|

| Inventory | $5,000 | $10,000 | ($7,500) | $7,500 |

The ending balance of $7,500 will be the starting inventory balance in the next accounting period. Ending with a balance higher than the beginning inventory balance can indicate that the business might need to:

- Reduce inventory purchases each period

- Purchase fewer low-selling items

- Buy in smaller bulks

This may help lower wasted costs, which can aid in improving revenue and profit margins.

Other possible Journal Entries

- Write-off of obsolete inventory - If a company has inventory that is no longer sellable due to damage, expiration, or other reasons, it may need to be written off. To record this, the company would debit the COGS account and credit the inventory account.

- Purchase returns - If there is defective or incorrect inventory from a supplier that needs to be returned, it should be recorded in the journal. The company would debit the accounts payable account and credit the inventory account.

- Sales returns - If a customer returns products to the company, this would need to be recorded. The company would debit the sales returns account and credit the accounts receivable or cash account.

- Cost of goods sold adjustment - In some cases, a company may need to adjust the cost of goods sold for a particular period. This may be necessary if, for example, there are errors in inventory counts that affect the COGS. To adjust the COGS, the company would debit or credit the COGS account, depending on the adjustment needed.

» Do you use Wix? Discover the best Wix inventory management apps

Manage Your Periodic Journal Entries With Confidence

Journal entries with the periodic system are simple and don't require constant sales tracking. These entries can help you keep track of inventory levels, costs, and profits. With BeProfit, you can achieve even more intuitive tracking through a one-stop dashboard that can monitor your profits and expenses in real time. This and proper journal recording can help you make informed decisions about your inventory and help ensure accurate financial reporting.