Your Guide to LTV/CAC Ratio in E-Commerce

Updated April 21, 2023

The LTV/CAC ratio may have some meaning to you, but to others, it might as well be a foreign language. Whether you are familiar with these e-commerce metrics or have no idea what they are about, they can help you get a clear understanding of your customers' probable behavior, as well as how much it will cost you to maintain the relationships that you build with them. That's because the LTV/CAC ratio measures the relationship between the lifetime value of a customer and the cost of attracting that customer.

» Learn more about other e-commerce metrics and how to calculate them by booking a demo with BeProfit

Customer Lifetime Value (LTV)

Your LTV predicts how much a customer will spend through a lifetime of interactions with your business. To calculate your LTV, you first need to look at your "churn" rate—how many customers cancel subscriptions in a month. Let's look at an example: if you have 500 customers and, on average, 5 cancel their subscriptions a month, your churn rate will be 1%. This will tell you how long, in general, your customers will keep their subscriptions.

Next, you need to calculate your gross margin. This is the percentage of the profit left over after paying your expenses.

Finally, you'll need a ballpark figure of how much money your average customer spends each month. Plug those amounts into this formula, and you'll get your LTV:

(gross margin %) X ( 1 / monthly churn ) X (average monthly subscription revenue per customer)

If a customer has a high LTV, they are one of your VIPs because they spend the most time with you over the longest period.

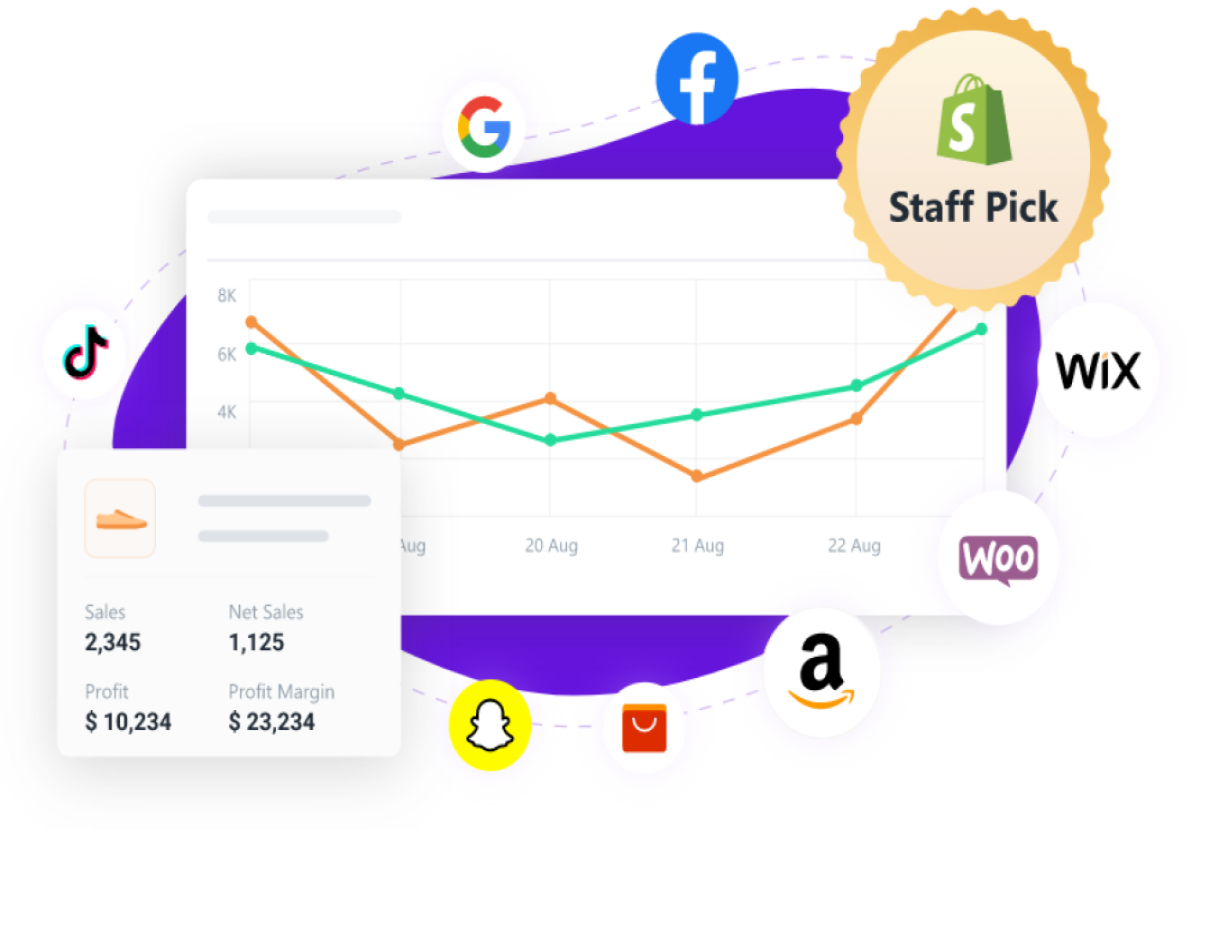

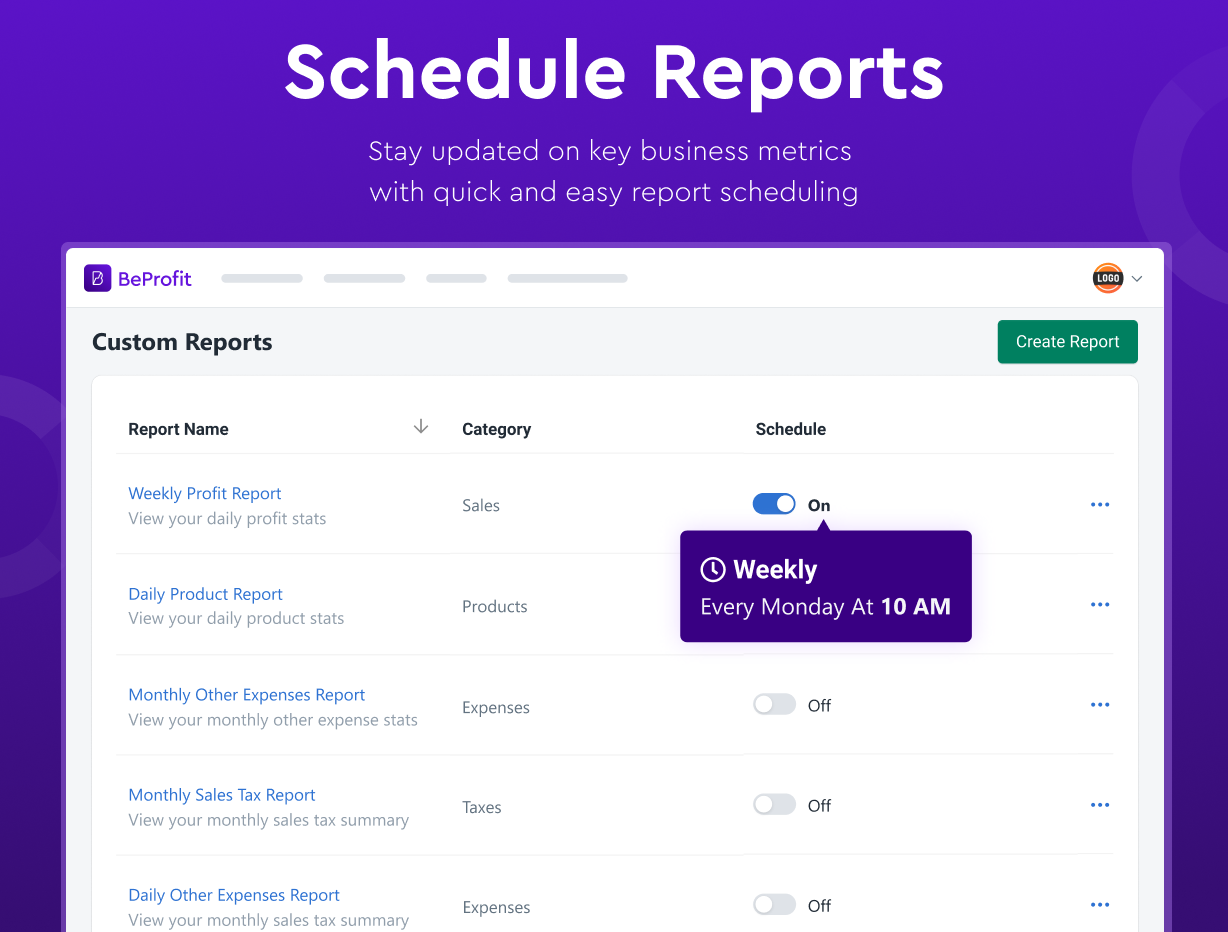

Get Deep-Level Insights on Your LTV

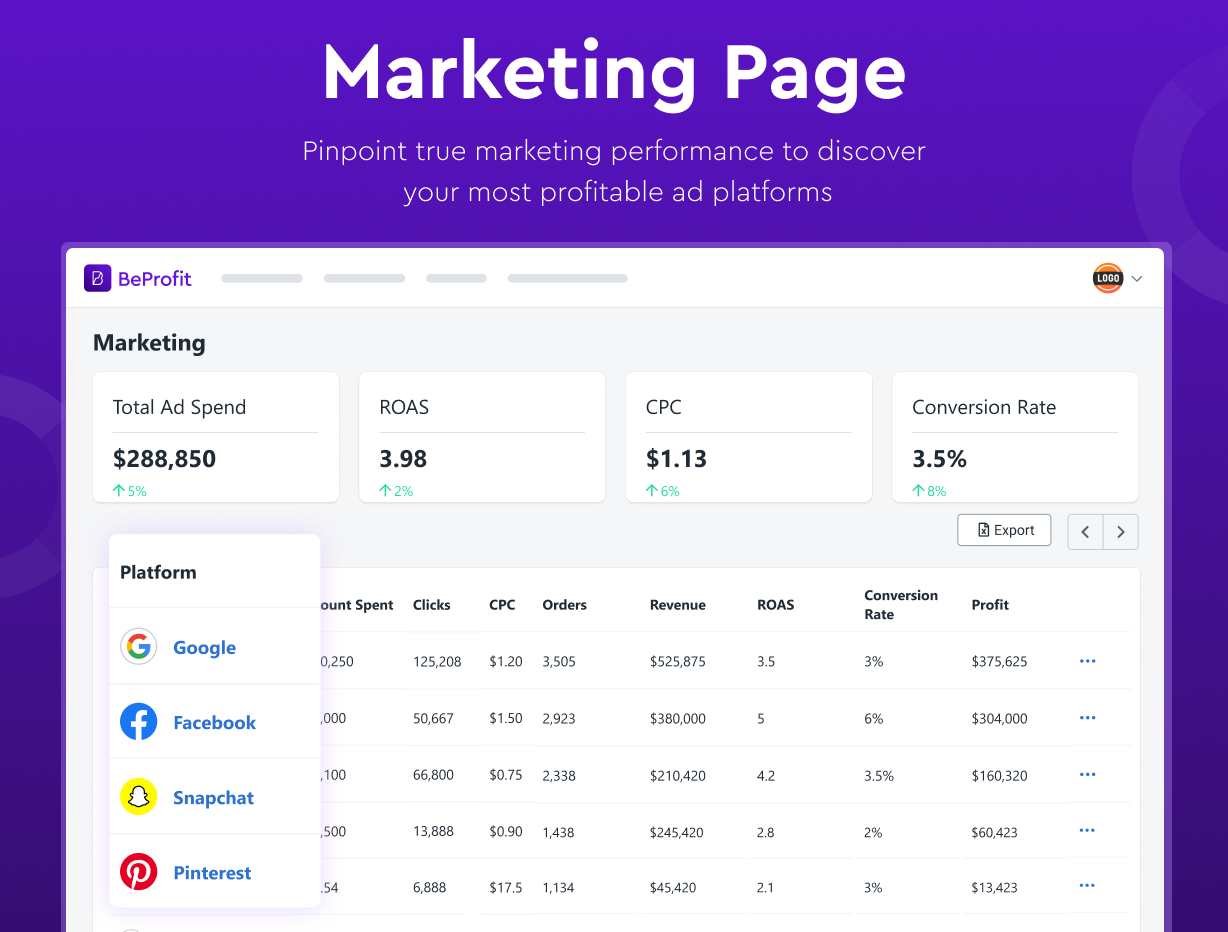

Use the Profit Analysis Dashboard's cutting-edge cohort analysis to gain in-depth understanding of your LTV and marketing effectiveness.

- Monitor revenue-based KPIs, such as cost per order, using a combination of automatic matching and human tagging.

- Pinpoint ROAS and conversion rates with the help of UTM attribution.

- Access the app from any computer or mobile device, at any time, and work in real time on a shared workspace with your teammates.

Customer Acquisition Cost (CAC)

CAC is the total cost you spend on marketing and advertising over a certain period to attract a customer.

To calculate your customer acquisition cost, follow this CAC payback formula:

(total cost of acquiring a customer + total sales expenses) / (the number of new customers acquired)

Examples of CACs include advertising, marketing, sales, training, employee wages, shipping, and taxes.

How to Calculate Your LTV/CAC Ratio

The formula for calculating your LTV/CAC ratio is:

[(revenue per customer – direct expenses per customer) / (1 – customer retention rate)] / (number of customers acquired / direct marketing spending)

Let's look at an example:

Your e-commerce company spends $10,000 on an advertising campaign and gains 1,000 new customers. The average revenue per customer is $60, and the direct cost of filling each order is $40. Your company retains 75% (= 0.75) of its customers per year.

customer contribution margin = $60 – $40 = $20

LTV = $20 / (1 – 0.75) =$80

CAC = $10,000 / 1,000 =$10

LTV/CAC ratio = $80 / $10 = 8.0 (or 8:1)

How to Analyze Your LTV/CAC Ratio

What is a good LTV to CAC ratio? The ideal ratio is around 3:1—which means that the value of your customer is three times more than the cost you paid to get the customer. You are spending too much if your ratio is lower, such as 1:1. On the other hand, you are missing out on business and spending too little if the difference is greater, such as 6:1.

This ratio may seem simplistic to you, but the fact is that, as an e-commerce business owner, you need to know these metrics. Why are they so important? Because you'll have a better understanding of the bigger picture—which will help you drive sales and grow your company over the long term.

Why Is the LTV/CAC Ratio Important for E-Commerce?

Many good reasons, including:

- It accurately points out how much you are spending on marketing, sales, and customer service.

- It enables you to master your strategies and processes, which will lower your business costs and increase your profits.

- It tells you exactly what your customers are worth to your business.

- It helps you to focus on giving your customers what they appreciate most.

- You won't be blindly throwing money at marketing campaigns and wasting your money.

How to Improve Your LTV/CAC Ratio

To optimize your LTV/CAC ratio, you need to focus on lowering your CAC. Here are six ways for you to reduce your CAC:

- Spend less on paid adverts Paid adverts may work when you are building awareness for your brand, but once your brand is established, you need to cut your paid ad costs. Over the long term, these costs are too high.

- Launch an affiliate program These programs work well with e-commerce companies because they give you more control over your CAC.

- Be data-driven All your business decisions should be driven by your data so that you can increase your customer lifetime value.

- Segment your customers By doing this, you can target your spending more accurately and increase customer profitability. There is a nifty formula that you can use to analyze your customer profitability called a customer profitability analysis.

- Invest in search engine optimization (SEO) while the initial outlay is high, over the long term, SEO pays for itself many times over.

- Develop a sales funnel A successful sales funnel is an essential marketing tool that will tell you if your customer is in the awareness, interest, decision, or action phase of the sales process. This will help you to accurately tweak your sales strategies to optimize your growth and build a successful and sustainable business over time.

Be One Step Ahead of Your Customers

If you want to effectively plan your marketing campaigns, you need to have a solid understanding of the behavior of your customers. Having said that, knowing the importance of metrics and ratios as well as understanding how to calculate CPA, CAC, LTV, and other key performance indicators (KPIs) serve as the foundation of every e-commerce business.

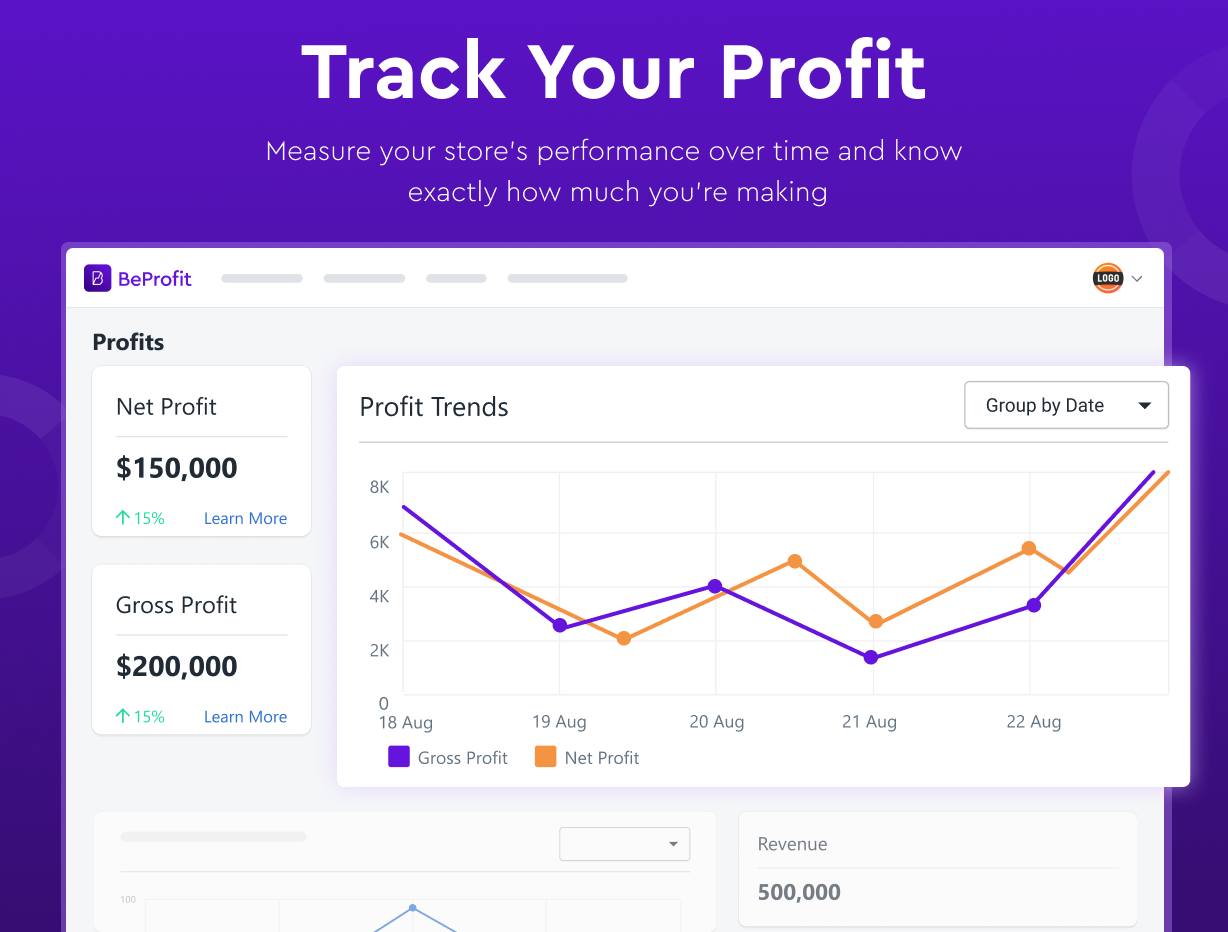

Using third-party apps is an innovative and easy way to keep track of all your data and calculate metrics. The Profit Analysis Dashboard by BeProfit, in particular, allows you to get a real-time overview of your store saving time and effort.

Discover more advantages of utilizing the Profit Analysis Dashboard for your business's growth: