Understanding CLV: Definition, Analysis & Examples

Updated April 25, 2023

A survey by eConsultancy shows that 76% of respondents view customer lifetime value (CLV) as a pertinent aspect of their business. However, only 42% were able to measure it. It may not be easy to accurately gauge how much revenue a customer will likely generate over their entire relationship with your business. Nonetheless, measuring and improving CLV can boost your bottom line and build long-lasting customer relationships.

What is CLV?

CLV is the estimation of total revenue per customer based on past and predicted purchases.

While there isn’t a one-size-fits-all answer to a good CLV metric, it's helpful to measure because if, for example, your CLV is lower than your usual customer acquisition costs (CAC), you are likely to lose profits and revenue. An ideal ratio here would be 3:1.

CLV is often alternately called lifetime value (LTV). Although these two don't have any material differences, LTV is sometimes more focused on the accumulated value of all customers.

Gain Insight To Boost CLV

BeProfit can help you understand your CLV through in-depth analysis, so you can make data-driven changes to your acquisition and marketing techniques if needed.

- Uncover actionable insights to improve your margin, profitability, and retention.

- Easily connect store and advertising platforms into one dashboard.

- Access the BeProfit app from mobile or desktop devices with ease.

How to Measure CLV

There are some variables you may need to calculate before getting to CLV, such as:

- Avg. Yearly Revenue Per Customer = Total Revenue / No. of Active Customers

- Gross Margin = Sales Revenue - Cost of Revenue

- Churn = % of customers that stopped using your product or service over time.

From there, you can work out the CLV using this formula:

CLV ($) = (Avg. yearly Revenue Per Customer X Gross Margin) / Churn

» Need some clarity? Learn how gross profit and gross margin differ

Understanding CLV: Examples

Scenario 1: “Good” CLV

Let's say an e-commerce business has an average yearly revenue per customer of $500. Its total revenue over the past year has been $1,000. Over the same period, it spent $500 on bringing and promoting its products to the market (the cost of revenue). Let’s also assume they had 100 customers at the beginning of the year and 20 left by year-end.

First, we'll need to work out the gross margin, then the CLV:

Gross Margin = Sales Revenue - Cost of Revenue

= ($1,000 - $500) / $1,000 x 100

= 0.5 or 50%

CLV ($) = (Avg. yearly Revenue Per User X Gross Margin) / Churn

= ($500 X 0.50) / 0.20

= $1,250

This is a good metric given that the CLV is more than three times the cost of revenue, meaning the business is reaping a profit.

Scenario 2: "Poor" CLV

Now, let's say a subscription-based software company has an average yearly revenue per user of $100, a gross margin of 70%, and a churn rate of 40%.

CLV ($) = (Avg. yearly Revenue Per User X Gross Margin) / Churn

= ($100 X 0.70) / 0.40

= $175

Here, a lower CLV can be a warning sign that the company needs to take action to improve its customer relationships and generate more revenue from its existing customer base.

Why is CLV Important?

CLV and positive customer-business relations go hand-in-hand. Without satisfied customers, your business can experience low sales and retention, which ultimately can negatively impact your bottom line.

So, let's look at how CLV relates to and influences the following facets of e-commerce businesses:

- Customer behavior and retention - When customers feel valued and engaged with a business, they are more likely to make repeat purchases over time, which can increase CLV.

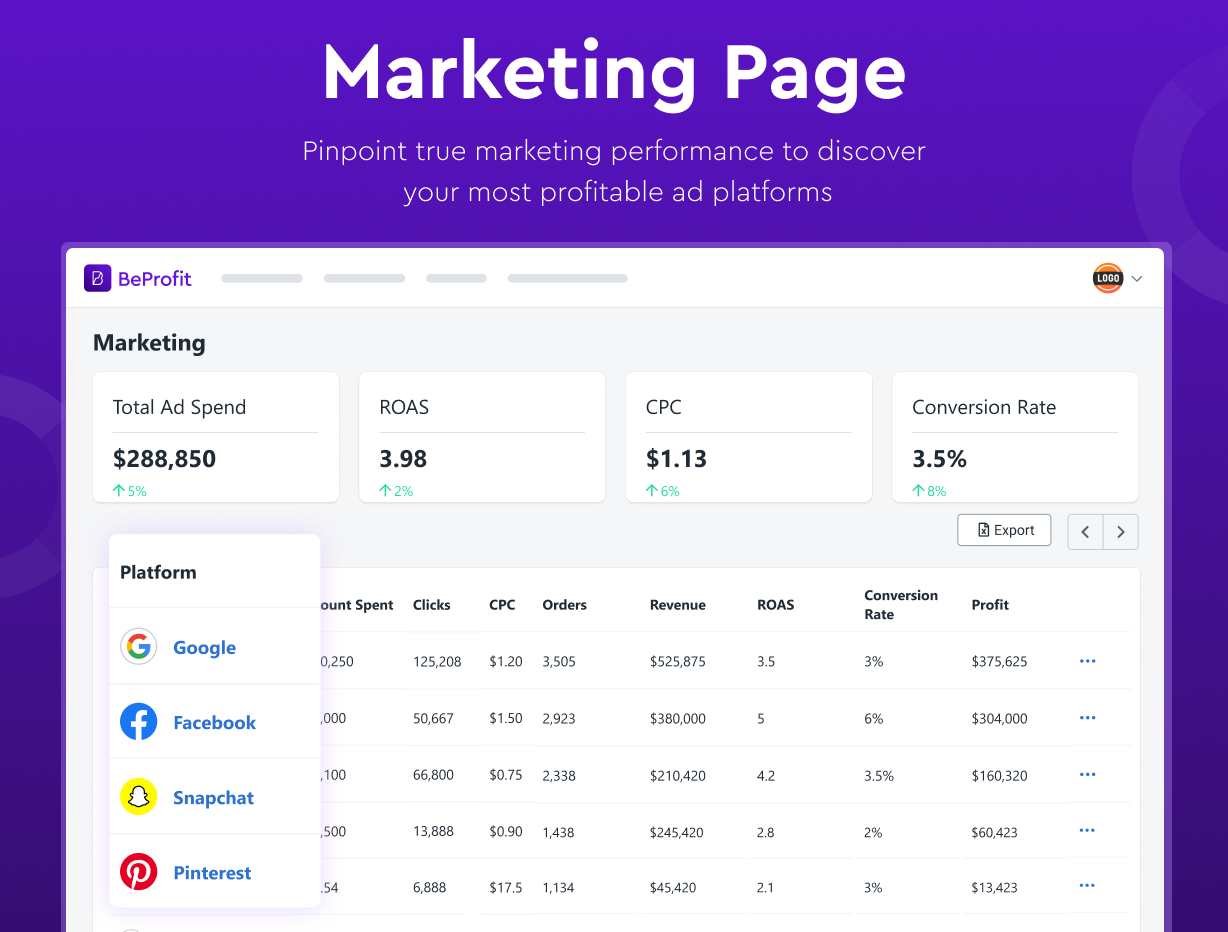

- Marketing - CLV can highlight whether marketing strategies, like email marketing, are effective or not, so businesses can then make informed adjustments to improve conversions.

- Average order value (AOV) - Loyal and satisfied customers are more likely to make larger purchases, which can boost CLV.

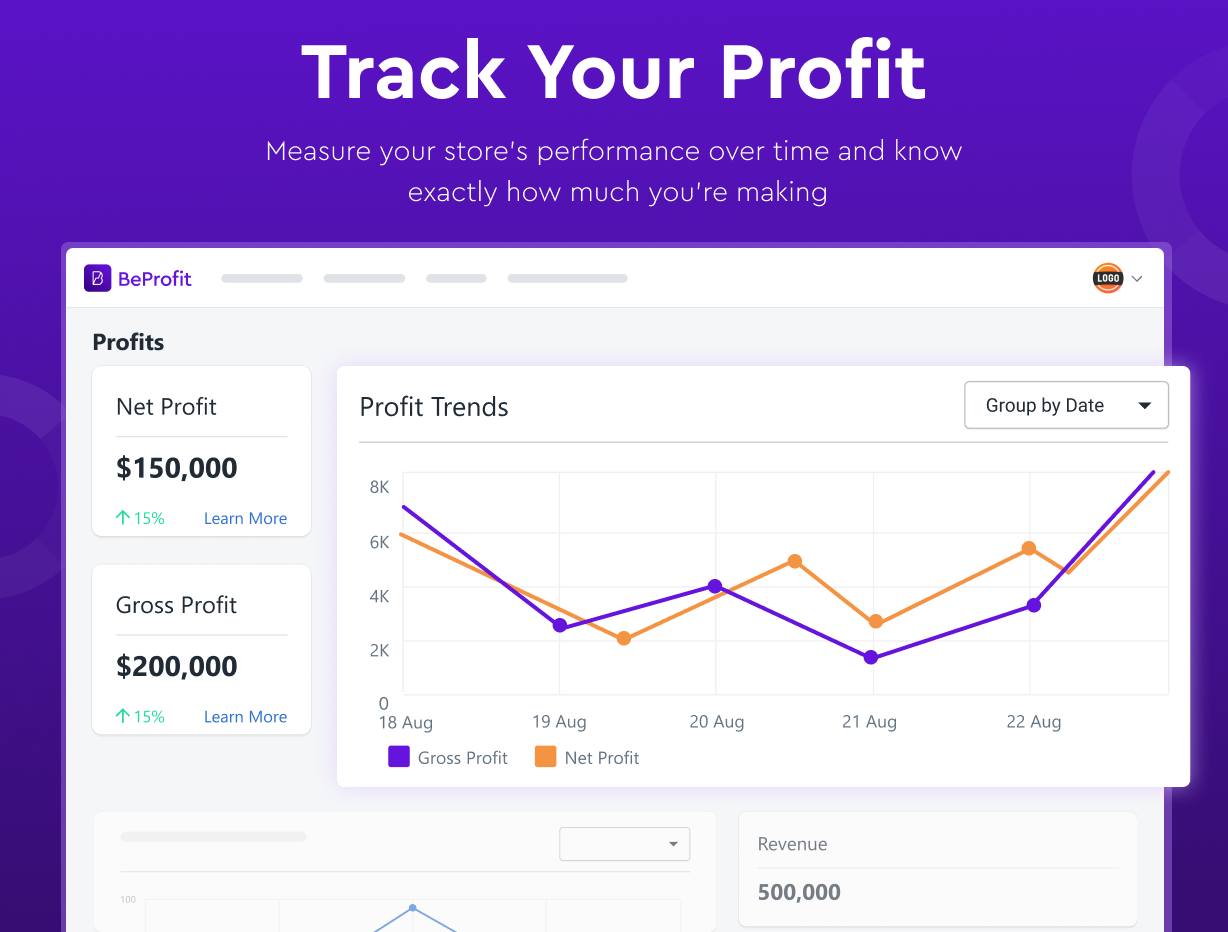

- Sales and profit - Understanding CLV can help businesses identify their most valuable customers and focus on retaining and growing those relationships. This can lead to more purchases, higher AOV, and larger profits.

How to Improve CLV

There are multiple strategies businesses can utilize to help increase their CLV and enjoy the benefits of the facets mentioned above. Some of these include:

- Loyalty programs - These can encourage repeat purchases, build customer retention, and maximize product profitability and CLV.

- Improved customer service - Customer satisfaction and loyalty can increase because customers may feel more understood. This can boost CLV and sales.

- Upselling and cross-selling - Recommending relevant products or services to customers based on their preferences and browsing habits can increase CLV as well as AOV.

- Leveraging social media - Businesses can build brand loyalty and encourage repeat purchases through strong online engagement, presence, and open customer feedback.

- Simplifying user experience - Optimizing sites, streamlining checkout, and providing clear product information can improve overall customer experience and increase sales and CLV.

» Find out how to double CLV methods from WooCommerce sellers

Boost Profits By Prioritizing CLV in Your Business

Analyzing CLV can aid in the success of an e-commerce business by providing insights into business performance. Leveraging strategies, like marketing and social media, can help improve customer retention and loyalty. This can reduce CAC, increase profits, and ultimately boost CLV.

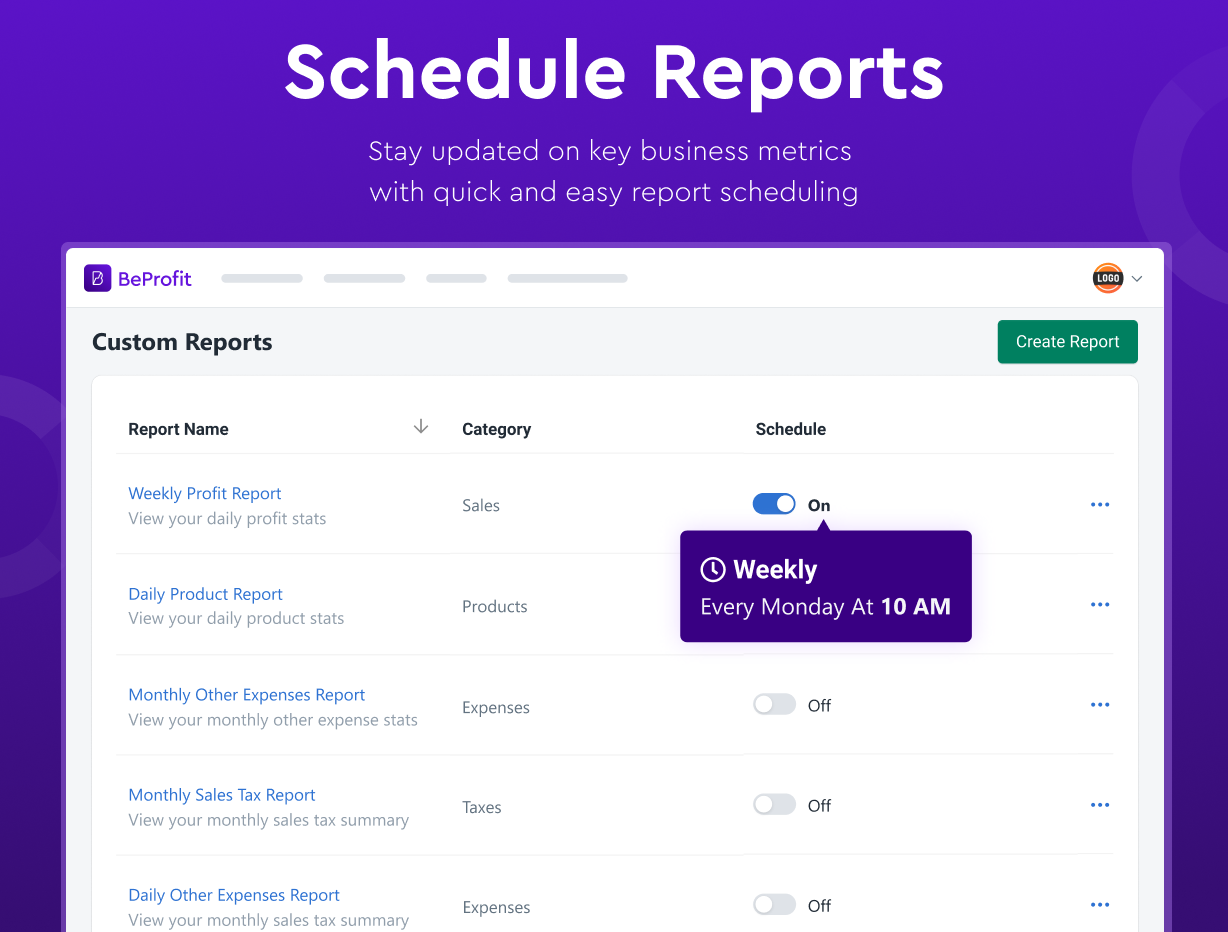

To this end, BeProfit offers an intuitive, all-in-one dashboard that allows businesses to track profits and sales data, which can be actioned to improve retention. BeProfit is a wonderful solution for businesses looking to take their CLV analysis to the next level for better revenue and profits.